How Europe's Banks Are Mainstreaming Digital Assets in 2026

European banking has entered a decisive new phase in 2026, as digital assets move from experimental sidelines into the core of financial strategy, risk management, and product design. For the readers of dailybusinesss.com, who follow developments in AI, finance, crypto, economics, and the future of global markets, Europe's banking transformation offers a revealing case study in how large, regulated institutions can embrace innovation while preserving trust, stability, and regulatory compliance. What began a decade ago as cautious curiosity toward Bitcoin and early blockchain projects has matured into a structured, multi-layered approach to tokenization, custody, decentralized finance (DeFi), and central bank digital currencies (CBDCs), with European banks now competing directly with fintechs, global tech platforms, and specialized digital-asset firms.

This shift is not occurring in isolation. It is unfolding in parallel with macroeconomic change, tighter monetary conditions, geopolitical fragmentation, and the rapid deployment of artificial intelligence across financial services. Banks in the European Union, the United Kingdom, Switzerland, and the Nordic and Southern European markets are rethinking how they serve clients, manage risks, and position themselves in global value chains. Readers who regularly consult the broader business coverage on dailybusinesss.com and its dedicated sections on business, finance, crypto, economics, and investment will recognize that digital assets are no longer a niche; they are becoming a structural component of Europe's financial architecture.

From Cautious Curiosity to Strategic Integration

European banks have historically been conservative, emphasizing capital preservation, regulatory compliance, and long-term client relationships. Yet by 2026, that conservatism has been tempered by a pragmatic recognition that ignoring digital assets would mean ceding ground to more agile competitors. What began as small innovation labs and isolated blockchain pilots has evolved into comprehensive digital-asset divisions, integrated into core banking systems and enterprise risk frameworks. Leading institutions now offer tokenized investment products, institutional-grade custody, and structured access to crypto markets for both retail and professional clients, often through the same digital channels that customers already use for traditional banking.

The transition has been driven by converging forces. Retail and high-net-worth clients in Europe and beyond have sought broader diversification and exposure to alternative assets, often informed by research and market data from platforms such as Bloomberg and Reuters. At the same time, blockchain technology has matured, with major public networks shifting to more scalable and energy-efficient consensus mechanisms, and enterprise-grade solutions emerging from providers like R3 and Hyperledger, whose frameworks are examined in depth by organizations such as the World Economic Forum. As digital assets have become more technically robust and operationally reliable, European banks have moved from passive observation to active participation, convinced that tokenization and programmable money can streamline settlement, unlock new liquidity pools, and enhance client service.

The change is especially visible in the way banks describe their strategy to investors, regulators, and the media. Annual reports, sustainability disclosures, and capital markets presentations increasingly refer to tokenized securities, digital-asset custody, and blockchain-based payment rails as core pillars of future competitiveness. Analysts at institutions like the Bank for International Settlements and the International Monetary Fund have documented how this evolution is reshaping balance sheets, capital allocation, and cross-border financial flows, reinforcing the perception that digital assets are now a structural, not cyclical, theme in European finance.

Regulation, Clarity, and the Role of MiCA

No element has been more decisive for Europe's digital-asset trajectory than regulation. The introduction and phased implementation of the Markets in Crypto-Assets (MiCA) framework in the European Union has provided a degree of legal clarity that many other regions still lack. By 2026, MiCA's rules on asset-referenced tokens, e-money tokens, and crypto-asset service providers have become a baseline for banks operating across the bloc, guiding how they structure custody, trading, issuance, and disclosure. Institutions that once hesitated due to regulatory uncertainty now find themselves with a clearer, if demanding, roadmap for compliance and risk management.

National supervisors, including BaFin in Germany, the Autorité des marchés financiers (AMF) in France, and the Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg, have translated EU-level rules into detailed supervisory expectations, often closely aligned with anti-money-laundering (AML) and counter-terrorist-financing (CTF) standards informed by the Financial Action Task Force. Banks have responded by strengthening transaction monitoring, deploying advanced analytics, and integrating AI-driven pattern recognition into their compliance operations. These same AI tools, which readers can explore further in the AI coverage on dailybusinesss.com, are now central to screening crypto flows, identifying anomalies, and satisfying both internal audit functions and external supervisors.

The European Central Bank (ECB), the European Banking Authority (EBA), and the European Securities and Markets Authority (ESMA) have also played pivotal roles, issuing guidance on prudential treatment, market integrity, and consumer protection. Their publications, available through the ECB and EBA websites, have helped define how banks should assess capital requirements for exposures to volatile crypto assets and stablecoins. For the UK, outside the EU framework yet tightly linked to European markets, the Financial Conduct Authority (FCA) and the Bank of England have developed their own regimes, with consultation papers and policy statements accessible via the FCA's official site. Together, these regulatory efforts have not eliminated risk, but they have transformed it into something that can be measured, managed, and priced within established prudential systems.

Partnerships, Tokenization, and the New Value Chain

As digital assets have matured, European banks have increasingly recognized that they cannot build every capability in-house. Instead, they have formed partnerships with specialist firms, integrating external platforms into their own regulated environments. Custody, trading infrastructure, blockchain analytics, and tokenization engines are often provided by fintechs and digital-asset companies, while banks contribute client relationships, balance sheet strength, and regulatory expertise. This division of labor has led to a new value chain in which roles are more modular, and collaboration is essential for scale.

Tokenization has been particularly transformative. Leading banks in Germany, France, Switzerland, and the Nordics now pilot or operate platforms that tokenize bonds, money market instruments, real estate, and private equity stakes, often building on standards and research from organizations such as the International Organization for Standardization and the International Capital Market Association. These tokenized instruments can settle more quickly than traditional securities, operate on a 24/7 basis, and support fractional ownership, opening access to previously illiquid or high-barrier assets. For readers of the markets and investment sections of dailybusinesss.com, this tokenization trend is reshaping how portfolios are constructed, how liquidity is managed, and how risk is distributed across geographies and investor classes.

Partnerships also extend into DeFi-adjacent infrastructure. While regulated banks cannot simply deploy client funds into unvetted decentralized protocols, they increasingly study and sometimes replicate DeFi mechanisms-such as automated market making and on-chain collateral management-within permissioned, compliant environments. Some banks collaborate with enterprise blockchain consortia and technology vendors that adapt DeFi ideas for institutional use, creating private or consortium chains where participants are fully identified and subject to conventional legal agreements. Reports from consultancies such as McKinsey & Company and Deloitte have outlined how these hybrid architectures may define the next generation of capital markets infrastructure.

Custody, Security, and Institutional-Grade Infrastructure

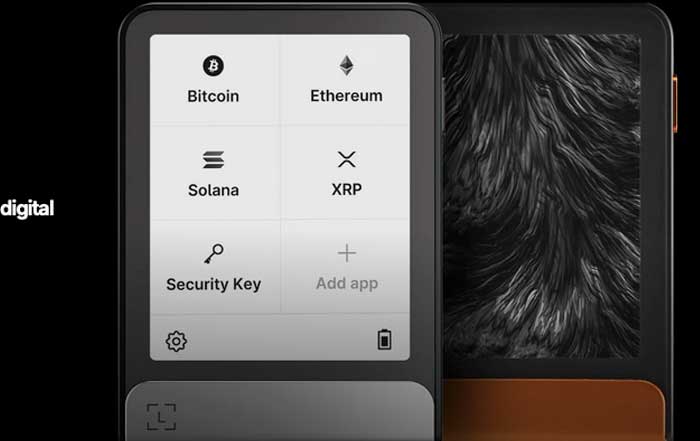

Digital-asset custody has emerged as a core competency for banks that wish to maintain their historical role as trusted guardians of client wealth. Unlike traditional securities, which are often held via centralized depositories, crypto assets require secure management of private keys and multi-layer technical controls. By 2026, major European institutions have implemented institutional-grade custody platforms, sometimes built in cooperation with hardware security providers and digital-asset infrastructure firms. Providers such as Ledger, whose enterprise solutions are described on its official site, have developed hardware security modules and key-management tools that integrate with bank-grade compliance and reporting workflows.

Security is not limited to cryptographic key storage. Banks have deployed real-time transaction monitoring, anomaly detection, and behavioral analytics to identify suspicious patterns across both fiat and digital ledgers. AI and machine learning, increasingly central to risk management as covered in dailybusinesss.com's technology section, now help detect fraud, phishing, and sophisticated cross-border laundering schemes that exploit the speed and pseudonymity of some blockchain networks. Cybersecurity teams coordinate closely with external threat-intelligence providers and national cyber agencies, while internal red teams test the resilience of digital-asset systems through simulated attacks and penetration testing.

Institutional clients, including asset managers, pension funds, and corporate treasuries, have responded positively to this enhanced security posture. Many prefer to hold digital assets through their existing banking partners rather than standalone crypto exchanges, valuing the continuity of service, consolidated reporting, and established dispute-resolution channels. This preference reinforces the centrality of banks in the emerging digital-asset ecosystem, even as non-bank players continue to innovate at the edges.

Stablecoins, CBDCs, and the Digital Euro

By 2026, stablecoins and CBDCs occupy a central place in Europe's digital-asset debate. Institutional and corporate users increasingly rely on regulated, asset-backed stablecoins for cross-border payments, liquidity management, and on-chain settlement. These instruments, often pegged to the euro, the US dollar, or the British pound, have become a practical tool for treasury operations, reducing the friction and delays associated with traditional correspondent banking. Analyses from the Bank of England and the European Central Bank have emphasized both the opportunities and systemic risks associated with large-scale stablecoin adoption, pushing regulators to demand robust reserves, clear redemption rights, and transparent governance from issuers.

CBDC development has progressed in parallel. The digital euro project, after extensive consultation and testing, has moved into advanced design and pilot phases, with banks playing a critical role as intermediaries and wallet providers. Central banks in Sweden, Norway, and Switzerland have similarly advanced their own CBDC experiments, often sharing research and technical insights through the BIS Innovation Hub. Commercial banks are deeply involved in these pilots, testing how CBDCs can coexist with deposits, how they affect liquidity management, and how they might enable new forms of programmable payments for retail and wholesale clients.

For banks, CBDCs and regulated stablecoins represent both an opportunity and a threat. On the one hand, they promise faster, cheaper, and more transparent payments, aligning with customer expectations shaped by real-time digital services in other industries. On the other hand, they raise questions about deposit disintermediation and the future role of banks in money creation and credit allocation. European institutions are responding by designing value-added services around CBDCs and stablecoins-such as integrated cash management, automated reconciliation, and programmable escrow-in order to remain indispensable even as the underlying form of money evolves.

Regional Dynamics: Germany, France, Switzerland, Nordics, and Southern Europe

The pace and shape of digital-asset adoption vary significantly across Europe's key markets, reflecting differences in regulation, market structure, and technological readiness. Germany has continued to consolidate its position as a leading jurisdiction for regulated crypto services, with clear legal definitions for crypto assets and a licensing regime that has attracted both domestic and international players. Major German banks now operate digital-asset trading desks, tokenized bond platforms, and institutional custody services, often targeting export-oriented corporates and institutional investors with cross-border exposures.

France has leveraged its early move toward a structured licensing framework for digital-asset providers, enabling large banks to partner with approved platforms and offer tokenization and custody under a well-defined supervisory regime. French institutions have been particularly active in tokenized securities and structured products, using blockchain to improve transparency and efficiency in capital markets. Switzerland, although outside the EU, remains a crucial reference point, with its Crypto Valley ecosystem, specialized private banks, and clear legal recognition of tokenized rights and ledger-based securities. Swiss banks continue to cater to global high-net-worth and institutional clients seeking bespoke digital-asset strategies under a stable, innovation-friendly legal framework.

In the Nordic region, high levels of digital adoption and robust e-identity infrastructure have enabled banks in Sweden, Norway, Denmark, and Finland to integrate crypto services seamlessly into existing mobile and online channels. These markets often serve as testbeds for advanced digital experiences, combining instant payments, open banking interfaces, and curated access to digital assets within a single app environment. Southern Europe, including Italy, Spain, and Portugal, has seen more uneven development, but specific niches-such as remittances, tourism-related payments, and small-business finance-have driven targeted use of stablecoins and blockchain-based solutions. Portugal's historically favorable tax treatment for crypto and Spain's focus on trade finance and supply-chain applications have attracted both fintechs and foreign capital, adding to the diversity of Europe's digital-asset landscape.

For global readers following world and trade coverage on dailybusinesss.com, these regional differences underscore that Europe is not a monolith. Instead, it is a mosaic of regulatory regimes and market cultures, within which banks must tailor their digital-asset strategies to local client demand, supervisory expectations, and competitive pressures.

ESG, Sustainability, and the Reputation of Digital Assets

As environmental, social, and governance (ESG) criteria have become central to investment and corporate strategy, European banks have been compelled to reconcile digital-asset adoption with sustainability commitments. Early concerns about the energy intensity of proof-of-work blockchains have given way to a more nuanced picture, as major networks have migrated to proof-of-stake and other lower-energy consensus mechanisms. Organizations such as the International Energy Agency and research groups at leading universities have produced more detailed assessments of blockchain's energy profile, enabling banks to distinguish between higher- and lower-impact networks.

Many European institutions now explicitly prefer to build services on energy-efficient chains and to disclose the environmental footprint of their digital-asset activities in sustainability reports. This aligns with the growing emphasis on sustainable finance, which readers can explore further in the sustainable business coverage of dailybusinesss.com. Some banks have gone further, supporting tokenized carbon credits and green bonds, using blockchain to enhance traceability and reduce double-counting in carbon markets. Partnerships with NGOs and climate-focused fintechs aim to ensure that tokenized environmental assets meet robust verification standards, in line with guidance from bodies such as the Task Force on Climate-related Financial Disclosures.

Socially, banks and regulators see an opportunity for digital assets to promote financial inclusion, provided that services are designed with appropriate safeguards. Lower-cost remittances, micro-investment platforms, and tokenized savings products can extend access to financial tools for underbanked communities across Europe and in connected regions in Africa, Asia, and Latin America. This aligns with broader development goals articulated by institutions such as the World Bank, even as policymakers remain vigilant about the risks of consumer harm and speculative excess.

Talent, Governance, and Organizational Change

The integration of digital assets into European banking has required a fundamental shift in skills, governance, and internal culture. Boards and executive committees now routinely discuss tokenization strategies, DeFi exposure, and CBDC readiness alongside traditional topics such as credit risk, capital ratios, and interest-rate sensitivity. To support informed decision-making, banks have recruited specialists in cryptography, blockchain engineering, digital-asset law, and quantitative risk modeling, often competing with technology companies and crypto-native firms for scarce talent.

Governance frameworks have evolved to reflect these new competencies. Many institutions have established digital-asset or innovation committees that bring together representatives from risk, compliance, technology, legal, and business units, ensuring that new initiatives are evaluated from multiple angles before launch. Internal audit functions have developed methodologies for reviewing smart-contract code, key-management procedures, and third-party service providers, often drawing on best practices shared through industry bodies and standard setters such as the Basel Committee on Banking Supervision. This structured approach reinforces the perception of European banks as cautious but determined adopters, focused on embedding digital assets within familiar, accountable governance structures.

Professional development has been equally important. Banks have launched training programs, certifications, and knowledge-sharing platforms to ensure that relationship managers, product specialists, and risk officers understand the fundamentals of digital assets and can communicate clearly with clients. This educational focus resonates with the broader mission of dailybusinesss.com to inform business leaders and founders, as highlighted in its founders and employment sections, about how emerging technologies are reshaping careers, competencies, and organizational design.

Competitive Positioning and Strategic Outlook

By 2026, Europe's banks are competing not only with each other but also with digital-native challengers, global payment platforms, and large technology firms entering the financial space. Some specialized "crypto banks" have obtained full banking licenses in select jurisdictions, offering seamless integration between fiat accounts, digital-asset portfolios, and DeFi access. Global exchanges and infrastructure providers continue to develop institutional products for European clients, leveraging their scale and technical expertise. This competitive pressure has pushed traditional banks to define clear strategic positions, whether as full-spectrum digital-asset providers, selective tokenization specialists, or cautious followers focused on core payments and custody.

Strategically, institutions that move early and invest deeply in digital-asset capabilities aim to capture new revenue streams from trading, custody, tokenization, and advisory services, while also using blockchain to reduce back-office costs and settlement times. Others prioritize risk containment, waiting for market structures and regulatory expectations to stabilize further before committing significant capital. Over time, as highlighted by scenario analyses from organizations like the OECD, the most successful banks are likely to be those that combine technological agility with disciplined risk management and transparent communication with clients and regulators.

For the global audience of dailybusinesss.com, spanning North America, Europe, Asia, Africa, and South America, Europe's experience offers a valuable reference point. It shows that digital-asset integration is not a binary choice between disruption and preservation but a complex, iterative process of experimentation, regulation, and institutional learning. The interplay between CBDCs, stablecoins, tokenized securities, and DeFi-inspired infrastructure will continue to evolve, influenced by macroeconomic conditions, geopolitical developments, and technological breakthroughs in AI, cryptography, and network design.

As 2026 progresses, European banks are no longer asking whether digital assets will matter; they are asking how to embed them into everyday banking in a way that strengthens trust, enhances client value, and aligns with broader societal goals. For decision-makers following developments through news and analysis on dailybusinesss.com, the message is clear: digital assets are becoming an integral part of the financial system's fabric, and Europe's banks intend to be at the center of that transition rather than watching from the sidelines.