Entrepreneurial Skills: How Modern Leaders Win in a Fractured, AI-Driven Economy

The 2026 Entrepreneurial Landscape: A DailyBusinesss Perspective

By 2026, entrepreneurship has become less about launching a product and more about orchestrating a complex system of technology, capital, talent, regulation, and global risk. Readers of DailyBusinesss-from founders in the United States and the United Kingdom to investors in Germany, Singapore, and South Africa-now operate in an environment where artificial intelligence, geopolitical fragmentation, climate pressure, and shifting consumer expectations are rewriting the rules of competitive advantage almost in real time. Ventures can scale from local experiments to global platforms with unprecedented speed, yet the same interconnectedness magnifies exposure to economic shocks, supply chain disruptions, cyberattacks, and reputational crises.

In 2026, the most effective entrepreneurs combine deep technical fluency with disciplined financial management, ethical judgment, and a sophisticated understanding of global markets. They recognize that success is no longer driven purely by product-market fit but by a broader portfolio of capabilities that align with the core themes covered on DailyBusinesss-from AI and technology to finance and investment, crypto and digital assets, employment and talent, and sustainable business models.

Global economic uncertainty, as tracked by institutions such as the International Monetary Fund and World Bank, has turned strategic foresight into a necessity rather than a luxury. Entrepreneurs are expected to read macroeconomic signals, understand regulatory shifts in the United States, Europe, and Asia, and anticipate how policy changes in areas like data protection, AI governance, and climate disclosure will affect their growth trajectory. Those who thrive in this context are not simply opportunistic; they operate with a long-term, systems-level mindset that aligns innovation with responsibility, growth with resilience, and speed with control.

Digital Savviness, AI Fluency, and Data Literacy

Digital competence is no longer a differentiator; it is the baseline. What distinguishes leading founders in 2026 is the ability to architect AI-enabled, data-centric organizations that can respond to market signals with precision and speed. Entrepreneurs now integrate advanced analytics, generative AI, and intelligent automation into every layer of the business, from customer acquisition and product design to supply chain optimization and risk management. Those who follow developments reported by DailyBusinesss on technology and AI understand that AI has moved from experimentation to mission-critical infrastructure.

Data literacy today extends far beyond dashboards and basic KPIs. High-performing leaders work with teams to build robust data pipelines, design experiments, and apply machine learning models that forecast demand, personalize customer experiences, and detect anomalies before they escalate into operational failures. Resources from organizations such as MIT Sloan and Stanford Graduate School of Business help entrepreneurs deepen their understanding of algorithmic decision-making and the trade-offs between accuracy, transparency, and fairness. Learn more about responsible AI governance and its implications for business strategy on sites like the OECD AI Observatory.

At the same time, data and AI sophistication must be matched with vigilance around cybersecurity and privacy. Regulations such as the EU's GDPR, the evolving AI Act in Europe, and state-level privacy requirements in North America have raised the bar for compliance. Entrepreneurs who operate across the United States, the United Kingdom, Germany, and Asia are expected to embed privacy-by-design principles, encryption standards, and zero-trust security architectures into their platforms. Guidance from organizations like ENISA in Europe and the U.S. Cybersecurity and Infrastructure Security Agency helps founders understand how to harden their systems and communicate their security posture credibly to customers and investors.

For readers of DailyBusinesss building AI-first ventures, the priority is not merely to adopt tools but to build internal competence. Structured learning through platforms like Coursera and edX allows executive teams to grasp the fundamentals of machine learning, data engineering, and model risk, ensuring that decisions about AI deployment are grounded in genuine expertise rather than vendor promises or short-term hype.

Strategic Foresight, Scenario Thinking, and Adaptability

In 2026, static business plans are liabilities. Strategic advantage now depends on the capacity to model multiple futures, test assumptions, and pivot quickly when evidence shifts. Entrepreneurs who follow macro and sector coverage on DailyBusinesss economics and world business trends recognize that geopolitics, climate events, and regulatory realignments can reshape demand patterns and capital flows in weeks, not years.

Strategic foresight involves structured scenario planning that considers alternative trajectories for interest rates, energy prices, AI regulation, and trade relationships between major blocs such as the United States, China, and the European Union. Organizations like the World Economic Forum and McKinsey & Company regularly publish scenario analyses that help entrepreneurs benchmark their own thinking against global risk narratives. Entrepreneurs who internalize these perspectives can identify where their business models are overexposed and where untapped opportunities may emerge, whether in green infrastructure, digital health, or cross-border e-commerce.

Adaptability is not a vague soft skill; it is operationalized through agile planning cycles, decision rights that empower teams close to the customer, and governance mechanisms that enable rapid resource reallocation. High-performing founders build portfolios of experiments, sunset underperforming initiatives without emotional attachment, and use real-time analytics to adjust pricing, product features, and go-to-market strategies. Learning more about strategic agility through curated courses on Skillshare or executive programs at leading business schools gives entrepreneurs a practical toolkit for navigating uncertainty rather than reacting to it.

Collaborative Leadership, Culture, and Global Team Management

The normalization of distributed and hybrid work, accelerated since 2020 and now deeply embedded in 2026, has redefined what effective leadership looks like. Entrepreneurs no longer manage teams confined to a single headquarters; instead, they orchestrate networks of talent across North America, Europe, Asia, and Africa. Readers of DailyBusinesss interested in employment and the future of work know that the most competitive ventures recruit engineers in Poland, designers in Spain, growth marketers in Singapore, and data scientists in Canada, building multi-time-zone organizations by design.

This model requires leaders who can build trust without constant physical presence, create clarity in asynchronous environments, and design rituals that bind people to a shared mission. Detailed onboarding, structured mentorship, and deliberate recognition of achievements are no longer optional; they are central to retention and performance. The Harvard Business Review and Gallup regularly highlight how psychological safety, transparent communication, and autonomy correlate with innovation and productivity, especially in remote and hybrid setups. Entrepreneurs who absorb these insights and translate them into operating norms-clear decision rights, documented processes, regular retrospectives-develop cultures that scale.

Cultural intelligence is equally vital. A founder based in London or Berlin who works with clients in Japan, South Korea, and the Middle East must understand local expectations around hierarchy, communication style, and negotiation etiquette. Resources from organizations like Cultural Intelligence Center and cross-cultural management research at INSEAD help entrepreneurs avoid costly misunderstandings that can derail partnerships or demotivate teams. For the DailyBusinesss audience, this is not theoretical; it is the lived reality of building teams and customer bases across continents, where misaligned assumptions can easily erode trust.

Emotional Intelligence, Ethics, and Trust as Strategic Assets

In a world where information spreads instantly and reputations can be damaged in hours, emotional intelligence and ethical clarity have become strategic assets. Investors, customers, and employees in markets from the United States and Canada to Sweden, Singapore, and New Zealand now expect founders to demonstrate empathy, transparency, and consistency between stated values and day-to-day decisions. Surveys from organizations like Edelman show that trust has become a key driver of brand loyalty and investor confidence, especially in sectors where AI, data, or financial products can significantly impact people's lives.

Emotional intelligence in 2026 is not limited to interpersonal charm; it encompasses self-awareness under pressure, the ability to manage one's own reactions in crises, and the skill of reading stakeholder sentiment across cultures and channels. Leaders who invest in coaching, reflective practices, and structured feedback loops are better equipped to navigate high-stakes negotiations, layoffs, product failures, or regulatory investigations without compounding harm. Platforms such as LinkedIn Learning and executive leadership programs from institutions like London Business School offer frameworks for developing these capabilities systematically.

Ethical decision-making has become more complex as AI, crypto, and data-intensive business models spread. Entrepreneurs must evaluate not only what is legal but what is acceptable to society, regulators, and their own employees. Organizations such as The Alan Turing Institute and Partnership on AI provide guidance on responsible AI, bias mitigation, and transparency, helping founders build governance frameworks that can withstand scrutiny from regulators in Europe, the United States, and Asia. For DailyBusinesss readers operating in finance, health, or critical infrastructure, embedding ethical review processes into product development is increasingly a prerequisite for regulatory approval and institutional partnerships.

Financial Acumen, Capital Strategy, and Market Discipline

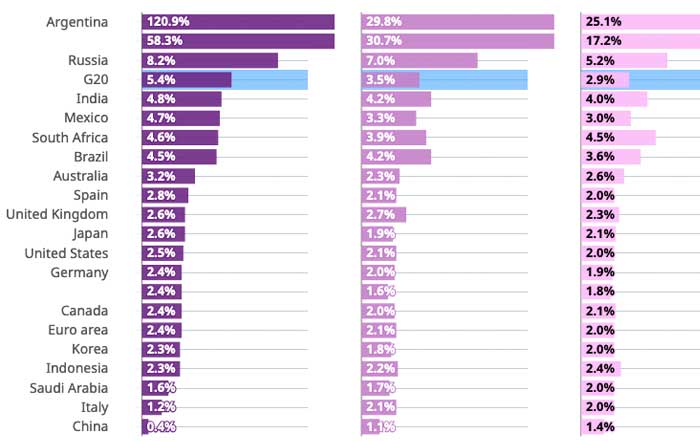

Financial literacy has always been important, but in 2026 it has become a decisive differentiator between ventures that survive volatility and those that do not. With interest rates, inflation, and capital availability fluctuating across regions, entrepreneurs must understand how macro trends, as reported by DailyBusinesss finance and markets, translate into cost of capital, valuation expectations, and funding risk. The era of growth-at-any-cost is largely over; investors in the United States, Europe, and Asia now reward disciplined growth, efficient unit economics, and credible paths to profitability.

Founders require a working command of cash flow management, scenario-based financial planning, and capital structure design. They must evaluate trade-offs between venture capital, revenue-based financing, strategic corporate partnerships, and debt instruments, recognizing that overreliance on a single source can become a vulnerability. Organizations like Kauffman Foundation and NVCA provide insights into evolving venture dynamics, while courses on edX and LinkedIn Learning offer practical modules on valuation, forecasting, and financial modeling tailored to entrepreneurs.

Market discipline also extends to portfolio thinking within the company. Rather than betting everything on a single product or segment, sophisticated founders stage investments, test new lines through pilots, and apply hurdle rates for continued funding. This approach is particularly relevant for readers of DailyBusinesss focused on investment and business strategy, who must balance ambition with risk management across global markets that can swing quickly in response to policy or sentiment.

Legal, Regulatory, and Governance Competence

By 2026, regulatory complexity has increased significantly, particularly in domains central to DailyBusinesss coverage such as AI, crypto, fintech, cross-border trade, and sustainable finance. Entrepreneurs cannot afford to treat legal and compliance functions as afterthoughts. They must anticipate how evolving frameworks-from the EU's Digital Markets Act and AI regulation to U.S. securities enforcement in digital assets and Asia-Pacific data localization rules-affect their product design, go-to-market strategy, and capital structure.

Strong governance is now an expectation even at early stages. Investors in London, New York, Berlin, and Singapore frequently evaluate board composition, audit practices, and risk oversight mechanisms before committing capital. Guidance from bodies such as the OECD, IFC, and national corporate governance codes helps founders design boards and advisory structures that combine independence with relevant domain expertise. Understanding intellectual property law, employment regulations, and cross-border tax implications is equally important, particularly for ventures that scale quickly across Europe, North America, and Asia.

Crypto and digital asset entrepreneurs, a core interest group for DailyBusinesss readers of crypto coverage, face particularly intense scrutiny. Regulatory bodies such as the U.S. SEC, FCA in the United Kingdom, BaFin in Germany, and MAS in Singapore have become more assertive in enforcing securities, AML, and consumer protection rules. Founders who integrate compliance into their architecture from day one, rather than retrofitting it under pressure, are more likely to secure banking relationships, institutional partnerships, and long-term investor support.

Innovative Marketing, Brand Narrative, and Customer Insight

Marketing in 2026 sits at the intersection of data science, storytelling, and community building. Entrepreneurs must navigate a fragmented media landscape where consumers in the United States, Europe, and Asia encounter brands through a mix of social platforms, niche communities, podcasts, newsletters, and immersive digital experiences. Those who follow DailyBusinesss news and trends understand that generic messaging no longer cuts through; brands must articulate a clear, credible narrative about their purpose, impact, and differentiation.

Sophisticated teams now use AI-driven analytics to segment audiences, predict churn, and optimize creative assets, while respecting privacy and consent frameworks. Tools informed by research from organizations like Nielsen and Gartner help marketers understand channel effectiveness and customer lifetime value with greater granularity. Learn more about advanced, data-informed marketing strategies through specialized programs on Coursera, which increasingly blend behavioral science, analytics, and creative execution.

Equally important is authenticity. User-generated content, transparent communication about product limitations, and visible responsiveness to feedback have become key drivers of trust, especially among younger consumers in markets like Germany, Brazil, and South Korea. Entrepreneurs who invite customers into product co-creation, acknowledge missteps publicly, and demonstrate progress on issues like sustainability and inclusion are building brands that can withstand short-term fluctuations in sentiment and algorithm changes.

Sustainability, Climate Risk, and Purpose-Driven Strategy

Sustainability has moved from the margins to the core of competitive strategy. Regulatory mandates such as the EU's Corporate Sustainability Reporting Directive and emerging climate disclosure rules in the United States and other jurisdictions require companies to measure and report their environmental and social impact in detail. For DailyBusinesss readers following sustainable business, this shift is transforming how entrepreneurs design products, choose suppliers, and communicate with stakeholders.

Climate risk is now a material financial issue. Organizations like the Task Force on Climate-related Financial Disclosures (TCFD) and CDP provide frameworks that help founders assess how physical risks (such as extreme weather events) and transition risks (such as carbon pricing or fossil-fuel phaseouts) affect their operations and markets. Entrepreneurs who integrate these considerations into capital allocation, site selection, and supply chain design can reduce volatility and appeal to institutional investors bound by ESG mandates.

Sustainability is also a source of innovation. Circular economy models, low-carbon materials, regenerative agriculture, and energy-efficient data infrastructure have created new categories of opportunity across Europe, Asia, Africa, and the Americas. Learning more about sustainable business practices through academic and practitioner resources, including specialized content on DailyBusinesss sustainable and trade coverage, helps founders identify where they can build defensible advantage by solving real environmental and social problems rather than treating ESG as a branding exercise.

Automation, Scalability, and Operational Resilience

Automation and cloud-native architectures remain central to scaling efficiently in 2026. Entrepreneurs who design their operations around modular, API-first systems can expand into new markets, integrate with partners, and launch adjacent products with far less friction than those tied to legacy systems. Readers of DailyBusinesss focused on technology and business infrastructure understand that this is not just a technical choice; it is a strategic one that influences speed, reliability, and cost structure.

Robotic process automation, AI-driven forecasting, and intelligent customer service tools reduce manual workload and error rates, allowing teams to focus on higher-value tasks such as product innovation and strategic partnerships. Case studies from firms analyzed by Deloitte and Accenture highlight how automation, when combined with thoughtful change management, can improve margins and resilience without eroding morale. Entrepreneurs who invest in training employees to work alongside AI, rather than simply replacing roles, build cultures that embrace technology as an enabler rather than a threat.

Operational resilience now requires redundancy in systems, suppliers, and data, particularly for companies with global footprints. The COVID-era shocks and subsequent supply chain crises prompted many ventures to diversify manufacturing and logistics across regions such as Southeast Asia, Eastern Europe, and Latin America. Insights from organizations like World Trade Organization and UNCTAD on trade flows and regulatory developments help entrepreneurs anticipate bottlenecks and design more flexible sourcing strategies that can withstand geopolitical or climate-related disruptions.

Global Communication, Reputation Management, and Stakeholder Alignment

In 2026, every entrepreneur is a global communicator by default. Whether speaking to investors in New York, employees in Melbourne, customers in Paris, or regulators in Singapore, founders must craft messages that are precise, culturally aware, and aligned with the organization's actions. Missteps in tone or substance can quickly escalate into reputational crises, amplified by social media and real-time commentary across continents.

Effective communication now blends data, narrative, and empathy. Founders who explain strategic decisions-such as price changes, layoffs, or product deprecations-through a lens that acknowledges stakeholder concerns, shares relevant metrics, and outlines concrete mitigation steps are more likely to retain trust. Resources from organizations like the Chartered Institute of Public Relations and executive communication programs at Wharton or HEC Paris provide templates and coaching for high-stakes messaging.

For the DailyBusinesss audience, which spans regions and sectors, this capability is especially important when operating in regulated or sensitive domains such as fintech, health tech, or AI infrastructure. Transparent communication with regulators, ecosystem partners, and affected communities is increasingly viewed as a marker of maturity and a prerequisite for scaling globally.

Continuous Learning and the Founder's Edge in 2026

The entrepreneurs who stand out in 2026 treat learning as a permanent discipline rather than a phase confined to early career stages. They curate a personal curriculum that blends technical education, market intelligence, and leadership development, drawing on platforms such as Udemy, Skillshare, and Coursera, while also engaging with peer communities, mentors, and industry events. This commitment to ongoing growth aligns closely with the information-rich ecosystem that DailyBusinesss provides across business, markets, and global trade.

Continuous learning also extends to the organization. Forward-looking founders institutionalize retrospectives, internal knowledge sharing, and cross-functional rotations so that teams build a shared understanding of both successes and failures. They track emerging trends through trusted sources such as OECD, IMF, and leading think tanks, then translate those insights into experiments rather than waiting for disruption to force reactive change.

For readers of DailyBusinesss across the United States, Europe, Asia, Africa, and South America, the message is clear: in 2026, entrepreneurial advantage is less about a single breakthrough idea and more about the disciplined accumulation of capabilities-technical, financial, ethical, and interpersonal-that allow a venture to adapt faster and execute better than its peers. Those who invest deliberately in these skills build companies that not only survive volatility but turn it into a catalyst for durable, trusted, and globally relevant growth.