Global Fintech in 2026: How Technology, Trust, and Regulation Are Rewriting Finance

The global fintech ecosystem in 2026 is no longer an experimental adjunct to traditional finance; it has become a core engine of economic activity and competitive advantage for institutions, founders, and policymakers across the world. What began as a wave of disruptive startups challenging incumbent banks has evolved into a deeply interconnected, data-driven financial infrastructure that underpins commerce in the United States, United Kingdom, Germany, Canada, Australia, France, Singapore, Japan, and far beyond. For the readers of DailyBusinesss, who follow developments in AI, finance, business, crypto, economics, and global markets, this transformation is not merely a sectoral story; it is a structural shift that is redefining how value is created, managed, and protected in a digital-first world.

In 2026, the most successful fintech players combine technological sophistication with disciplined governance and an explicit focus on trust. They operate at the intersection of advanced analytics, robust regulatory compliance, and human-centered design, serving both mature markets in Europe, North America, and Asia, and rapidly digitizing economies in Africa and South America. As this article examines the state of digital banking, blockchain, artificial intelligence, open banking, data analytics, payments, cybersecurity, and regulatory technology, it does so from the vantage point of a global business audience that must make decisions today about investments, partnerships, and risk strategies that will shape their competitive position for the rest of this decade.

Digital-Only Banking Becomes a Core Banking Model

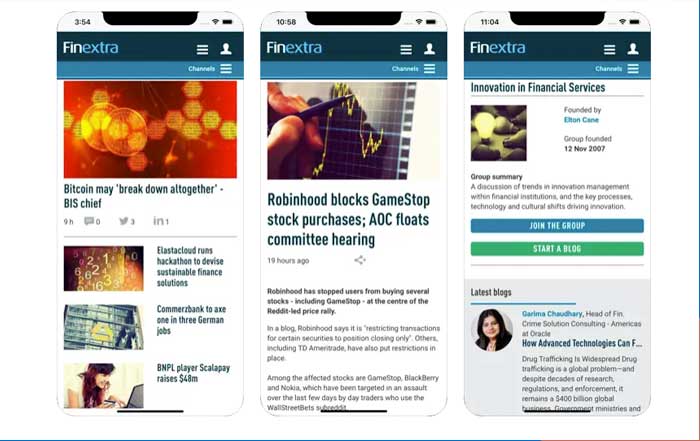

By 2026, digital-only banks are no longer perceived as niche challengers; they are recognized as fully fledged financial institutions that set the benchmark for user experience, operational efficiency, and product innovation. Neobanks across the US, UK, Germany, Brazil, India, and Southeast Asia have demonstrated that branchless models can scale to tens of millions of customers while maintaining robust compliance and effective risk management, especially when they embed advanced analytics and automation in their core processes. The shift toward digital-only banking has been accelerated by the normalization of contactless payments, remote work, and global mobility, all of which demand 24/7, border-agnostic access to financial services.

For business leaders and founders who follow global banking and markets coverage on DailyBusinesss, the strategic lesson is clear: customer expectations are now defined by the most intuitive app on a user's phone, not by legacy norms in retail banking. Leading digital banks have integrated tools for real-time cashflow tracking, automated savings, goal-based investing, and even tax optimization, turning what used to be static current accounts into dynamic financial command centers. In markets such as the Nordics, Singapore, and South Korea, where digital identity infrastructure and high-speed connectivity are widespread, digital-only banks have become the default choice for younger demographics and globally mobile professionals.

Traditional banks have responded with varying degrees of urgency. Some have launched standalone digital brands, built greenfield tech stacks, and partnered with fintech providers to accelerate modernisation. Others have invested in core system upgrades and API layers to emulate the agility of neobanks without abandoning their branch networks. The most sophisticated incumbents now operate hybrid models: they maintain physical presence for complex advisory services and high-value corporate relationships, while shifting routine transactions and onboarding to digital channels. Industry analyses from organizations such as the Bank for International Settlements underscore that digital transformation is now a prudential issue as much as a strategic one, because outdated technology can itself become a source of operational and cyber risk.

In emerging markets across Africa, South Asia, and Latin America, digital-only and mobile-first banks have become powerful instruments of financial inclusion. Leveraging smartphone penetration and alternative data, they extend payments, savings, and microcredit to populations historically excluded from formal banking. Institutions inspired by the experience of Kenya's mobile money revolution and regulatory frameworks promoted by bodies like the Alliance for Financial Inclusion have shown that well-designed digital infrastructure can unlock entrepreneurship, smooth consumption, and increase resilience to shocks. For investors who monitor fintech and investment trends, these markets now represent some of the most dynamic growth opportunities in financial services.

Nevertheless, the viability of pure-play neobanks still hinges on sustainable unit economics. The era of easy capital that characterized the late 2010s and early 2020s has given way to more cautious funding conditions, particularly as interest rate cycles in the US, Eurozone, and UK have shifted. Digital banks that relied heavily on interchange fees and rapid customer acquisition must now prove their ability to generate stable net interest margins, fee income from value-added services, and disciplined credit performance. Analysts from platforms like McKinsey & Company have repeatedly emphasized that digital convenience is necessary but not sufficient; robust governance, risk culture, and diversified revenue streams are now the decisive differentiators.

Blockchain, Digital Assets, and Institutional-Grade Infrastructure

The blockchain and digital asset landscape in 2026 is markedly more institutional, regulated, and integrated than the speculative environment that dominated the early crypto cycles. While retail speculation in cryptocurrencies still captures media attention, the most consequential developments are occurring in tokenized assets, regulated stablecoins, and central bank digital currency experiments across Europe, Asia, and North America. Major financial centers such as London, New York, Frankfurt, Singapore, and Zurich host consortia where banks, market infrastructures, and fintech firms collaborate on distributed ledger platforms for settlement, collateral management, and cross-border liquidity.

Stablecoins, once viewed primarily as tools for crypto trading, have matured into regulated payment instruments in several jurisdictions. Frameworks developed by authorities like the European Central Bank and the Monetary Authority of Singapore distinguish between systemic and non-systemic stablecoins, impose reserve, disclosure, and redemption requirements, and clarify the roles of issuers, custodians, and intermediaries. For corporates engaged in international trade and treasury management, regulated stablecoins and tokenized deposits now offer faster, cheaper settlement options than many legacy correspondent banking arrangements, especially in corridors between Europe, Asia, and Africa.

Tokenization has also advanced from concept to implementation. Real estate, private credit, infrastructure projects, and even fine art have been fractionalized into digital securities on permissioned blockchains, enabling broader investor access and more efficient secondary markets. Asset managers and exchanges in Switzerland, Germany, Japan, and the United Arab Emirates are piloting or operating regulated tokenized markets, often under digital asset regimes informed by the work of the International Organization of Securities Commissions. For sophisticated investors and family offices who follow crypto and alternative asset coverage on DailyBusinesss, tokenization provides a pathway to diversify portfolios with historically illiquid assets while benefiting from enhanced transparency and automated compliance.

At the same time, the more permissionless segments of the crypto ecosystem, including decentralized finance (DeFi), have been forced to confront regulatory expectations around investor protection, market integrity, and anti-money laundering. High-profile failures and exploits in previous years have led regulators in the US, UK, EU, and Asia-Pacific to demand stronger governance, clearer disclosure, and more robust risk controls from platforms that facilitate lending, derivatives, and staking. Institutions that wish to engage with DeFi now typically do so via regulated on-ramps, curated protocols, or enterprise-grade infrastructure providers. Research from entities such as the IMF has highlighted both the systemic risks and the potential efficiency gains associated with integrating decentralized technologies into mainstream finance, reinforcing the need for carefully calibrated oversight.

For business leaders, the strategic implication in 2026 is that blockchain is no longer a binary choice between traditional systems and unregulated experimentation. Instead, it has become a spectrum of architectures-from public networks to permissioned ledgers-each suited to different use cases in payments, trade finance, securities issuance, and supply chain transparency. Enterprises in manufacturing, logistics, and retail increasingly use distributed ledgers to verify provenance, track carbon footprints, and automate complex multi-party workflows, aligning with broader ESG and sustainable business agendas. The firms that create value in this environment are those that view blockchain not as an ideology but as an enabling infrastructure, integrated with existing risk frameworks and regulatory regimes.

Artificial Intelligence as the Financial Co-Pilot

Artificial intelligence in 2026 has moved decisively from tactical use cases to strategic orchestration across the financial value chain. Leading banks, insurers, asset managers, and fintech firms deploy AI not only for credit scoring and fraud detection, but for dynamic pricing, real-time risk management, and hyper-personalized customer engagement. The rise of large language models and advanced machine learning architectures has enabled conversational interfaces that can interpret complex customer queries, generate tailored financial guidance, and interact with back-end systems in natural language, drastically reducing friction in both retail and corporate workflows.

For the DailyBusinesss audience following AI and technology trends, the most consequential shift is that AI is now embedded in core decision-making processes rather than confined to peripheral analytics. In lending, models incorporate a broader range of structured and unstructured data to assess creditworthiness, improve early warning systems, and refine recovery strategies, particularly in markets facing macroeconomic uncertainty. In capital markets, AI-driven trading strategies analyze vast datasets-from order books and macro indicators to news sentiment and even satellite imagery-to identify patterns that human analysts would struggle to detect, while risk engines run continuous scenario analyses to stress portfolios under multiple volatility regimes.

However, the expansion of AI has brought explainability, fairness, and accountability to the forefront of regulatory and governance agendas. Supervisors in the EU, UK, US, Singapore, and Canada have published guidelines and, in some cases, binding rules that require institutions to demonstrate that AI-based decisions, particularly in credit and insurance underwriting, do not result in unlawful discrimination. The emerging discipline of "responsible AI" has become a board-level concern, with institutions establishing ethics committees, model risk management frameworks, and audit trails that document how AI systems are trained, validated, and monitored. Organizations such as the OECD have provided high-level principles that many jurisdictions reference as they craft local frameworks.

Operational resilience is another area where AI has become indispensable. Financial institutions use anomaly detection to monitor transaction flows, network activity, and application performance, flagging irregularities that might indicate cyber intrusions, system failures, or operational bottlenecks. Combined with real-time observability tools, AI enables faster incident response and minimizes downtime, which is critical in a world where customers expect uninterrupted access to digital services. For global institutions with operations in North America, Europe, Asia-Pacific, and Africa, AI-enhanced resilience is now a prerequisite for maintaining regulatory confidence and customer trust.

The rise of generative AI has also transformed internal productivity. Knowledge workers in finance increasingly rely on AI assistants to draft reports, summarize regulatory updates, generate code, and prepare client proposals, freeing human experts to focus on judgment-intensive tasks and strategic decision-making. Consultancies and think tanks, including McKinsey & Company and the World Economic Forum, have documented significant productivity uplifts where AI is thoughtfully integrated into workflows, though they also caution that benefits are unevenly distributed and require substantial investment in data infrastructure, change management, and workforce reskilling.

For executives and founders, the key challenge in 2026 is to move beyond pilot projects and isolated AI deployments to a coherent enterprise AI strategy that aligns with risk appetite, regulatory expectations, and long-term business objectives. This includes clarifying data ownership, investing in secure and scalable infrastructure, and addressing talent gaps in data science, machine learning engineering, and AI governance. The organizations that succeed will be those that treat AI not merely as a cost-saving tool but as a strategic co-pilot, augmenting human judgment across finance, risk, compliance, and customer experience.

Open Banking, Open Finance, and Embedded Experiences

Open banking, which began as a regulatory initiative to increase competition and consumer choice, has evolved by 2026 into a broader open finance paradigm that spans payments, investments, pensions, insurance, and even non-financial data sources. Standardized APIs, secure consent frameworks, and interoperable data formats now allow individuals and businesses in markets such as the UK, EU, Australia, and Brazil to aggregate their financial lives across multiple providers into unified dashboards. For readers of DailyBusinesss tracking employment, founders, and SMEs, this has profound implications for cashflow management, access to credit, and financial planning.

Third-party providers use open data to build services that were difficult or impossible under closed architectures. Accounting platforms can reconcile bank transactions in real time, tax tools can pre-populate filings with verified data, and lenders can underwrite small businesses based on live cashflow rather than static financial statements. In markets where regulators and industry bodies have promoted common standards-often inspired by work from the Open Banking Implementation Entity and similar organizations-ecosystems have flourished around API-enabled innovation, lowering barriers to entry for startups while challenging incumbents to differentiate on service quality and trust.

The trend has naturally extended into embedded finance, where non-financial platforms integrate payments, lending, insurance, and investment products directly into their user journeys. E-commerce marketplaces in North America, Europe, and Asia offer instant working capital loans based on sales histories; ride-hailing and delivery apps provide drivers with integrated savings and micro-insurance; B2B software providers embed invoicing, FX, and treasury tools for mid-market corporates. Payment and banking-as-a-service providers, including firms like Stripe, have become critical infrastructure, enabling brands to offer financial products without becoming regulated banks themselves. Articles and resources from Stripe highlight how this embedded model is reshaping the economics of payments and financial services globally.

Yet open finance also raises complex questions around data privacy, liability, and competition. Regulators must balance the benefits of interoperability with the risks of data concentration in large platforms that aggregate financial information across millions of users. Frameworks such as the EU's evolving data strategy and guidelines from the European Banking Authority emphasize explicit consent, purpose limitation, and data minimization, while also addressing issues such as screen-scraping and non-standard APIs. For global companies operating across Europe, Asia-Pacific, and North America, harmonizing compliance across jurisdictions is now a non-trivial strategic and operational task.

From the customer's perspective, the success of open finance hinges on trust and clarity. Users are increasingly sophisticated about data rights and security, but they also expect tangible value in exchange for consent. Providers that clearly explain how data is used, offer intuitive controls to manage permissions, and demonstrate strong security postures are more likely to earn long-term loyalty. For the DailyBusinesss readership, which spans executives, investors, and policy observers, open finance is best understood as a foundational layer that enables the next generation of business models, from context-aware financial coaching to real-time, usage-based insurance and intelligent cross-border cash management.

Data Analytics as the Strategic Nerve System

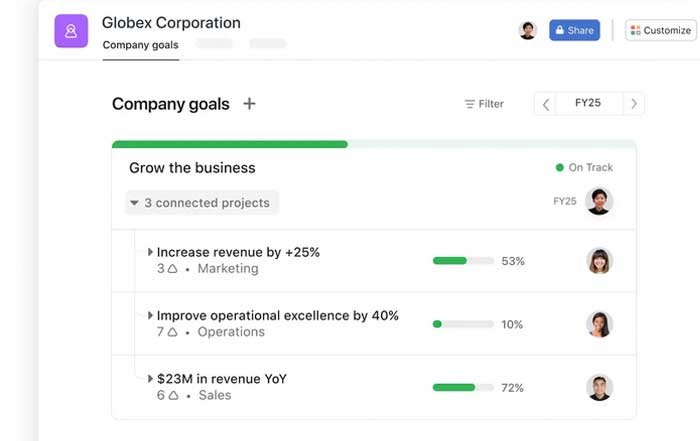

In 2026, data analytics is the strategic nerve system of modern finance. Institutions that can collect, integrate, and interpret data across products, channels, and geographies have a decisive advantage in pricing, risk management, customer retention, and regulatory compliance. The shift from descriptive to predictive and prescriptive analytics has been particularly pronounced in global banks and fintech platforms that operate in multiple regions, where understanding localized behavior patterns and macroeconomic conditions is essential to managing volatility and credit cycles.

Advanced segmentation allows financial institutions to move beyond broad demographic categories to highly granular, behavior-based profiles. Transaction histories, device usage patterns, geolocation, and even lifestyle indicators are used-subject to privacy and consent requirements-to tailor propositions in real time. For example, a customer in Canada who frequently travels between Toronto, London, and Singapore may be offered a dynamic FX and travel insurance bundle, while a freelancer in Spain with irregular income flows might receive personalized cashflow smoothing tools and short-term credit options. Insights from organizations like Deloitte illustrate how such data-driven personalization can significantly increase engagement and reduce churn.

Risk and compliance functions rely heavily on analytics to keep pace with increasingly complex regulatory expectations. Anti-money laundering systems use network analytics to identify suspicious transaction patterns across borders, currencies, and institutions, often integrating external data from sanctions lists and adverse media. Stress testing frameworks incorporate macroeconomic data from sources such as the World Bank and the OECD to model the impact of shocks on capital and liquidity positions. For firms that report across multiple jurisdictions, automated regulatory reporting powered by analytics has become critical to meeting timelines and avoiding costly errors.

However, the power of analytics is constrained by data quality, architecture, and governance. Financial institutions that grew through mergers and acquisitions often grapple with fragmented legacy systems, inconsistent data definitions, and siloed repositories. Modernization efforts increasingly focus on building unified data platforms-often cloud-based-that can ingest, normalize, and secure data from multiple sources while ensuring appropriate access controls and auditability. Regulators and industry bodies, including the Basel Committee on Banking Supervision, have stressed that sound data governance is a prerequisite for effective risk management and supervisory confidence.

For the audience of DailyBusinesss, particularly those in leadership roles, the implication is that data strategy is now business strategy. Decisions about which data to collect, how to structure it, which analytics capabilities to build or buy, and how to govern access are central to competitiveness in finance, markets, and trade. Institutions that treat data as a shared enterprise asset, rather than a departmental byproduct, are better positioned to innovate, comply, and respond to rapidly changing market conditions in North America, Europe, Asia, and beyond.

Payment Innovation and the New Rails of Commerce

Payment technology in 2026 has become a visible barometer of how fast fintech innovation can reshape everyday behavior. Consumers and businesses in the US, UK, EU, India, China, Singapore, and Brazil now take for granted instant or near-instant payments, seamless checkout experiences, and the ability to transact across borders with a few taps on a device. The convergence of real-time payment systems, mobile wallets, QR codes, and tokenized credentials has reduced friction in domestic and international commerce, while also opening new avenues for fraud and regulatory scrutiny.

Real-time payment infrastructures, such as FedNow in the United States and SEPA Instant Credit Transfer in Europe, have become key enablers of innovation. Fintech firms build overlay services on top of these rails, offering request-to-pay features, intelligent invoicing, and automated reconciliation for SMEs and corporates. In Asia, systems such as India's UPI and Singapore's FAST and PayNow have demonstrated how interoperable QR codes and mobile identifiers can dramatically expand digital payment adoption, including among small merchants and rural populations. Central banks and multilateral organizations like the Bank for International Settlements have documented how these systems can lower transaction costs and support inclusive growth.

Digital wallets and super-apps continue to blur the lines between payments, commerce, and financial services. Platforms that began as messaging or ride-hailing apps now offer savings, credit, insurance, and investment products, particularly in Asia-Pacific and parts of Africa. In advanced economies, technology companies and fintechs provide wallet solutions that integrate loyalty, subscriptions, and buy-now-pay-later offers, while also experimenting with digital identity and age verification. Merchants benefit from richer transaction data and targeted marketing capabilities, but must also navigate increased dependence on a small number of powerful platforms.

Cross-border payments, historically plagued by opacity, delays, and high fees, are undergoing structural change. New networks leveraging both conventional clearing systems and blockchain-based rails offer faster settlement and increased transparency, especially for SME trade flows between Europe, Asia, and Africa. Initiatives supported by organizations such as the Financial Stability Board aim to address fragmentation by encouraging interoperability and common standards for messaging, compliance, and data sharing. For importers, exporters, and global supply chain participants who follow world and trade coverage on DailyBusinesss, the evolution of cross-border payments is directly linked to working capital efficiency and competitiveness.

Security remains both an enabler and a constraint. Tokenization, device binding, behavioral biometrics, and AI-based anomaly detection have significantly reduced certain categories of fraud, but attackers continuously adapt. Regulatory initiatives such as Strong Customer Authentication in Europe and evolving guidance from the US Federal Reserve and other central banks seek to balance security with user experience. Providers that can abstract complexity, offering secure yet friction-light flows for consumers and corporates, are best positioned to capture share in an increasingly crowded payments landscape.

Cybersecurity and RegTech as Pillars of Trust

As financial services have migrated to the cloud and become more interconnected, cybersecurity and regulatory technology (RegTech) have emerged as foundational pillars of trust. In 2026, boards and regulators alike recognize that cyber resilience is not merely an IT concern but a strategic and systemic risk issue. High-profile incidents in multiple regions over the past few years have underscored the potential for cascading disruptions across payment systems, markets, and critical infrastructure if security is not continuously strengthened.

Financial institutions now adopt layered defense strategies that combine advanced encryption, zero-trust architectures, continuous authentication, and AI-driven threat intelligence. Collaboration has intensified through information-sharing forums and public-private partnerships, often coordinated by national cybersecurity centers and international bodies. For example, frameworks and guidance from the National Institute of Standards and Technology and the European Union Agency for Cybersecurity inform best practices across North America and Europe, while regulators in Asia-Pacific and Africa adapt these principles to local contexts.

RegTech solutions, meanwhile, have become indispensable to managing the expanding volume, complexity, and frequency of regulatory obligations. Automated KYC and AML platforms ingest data from global watchlists, corporate registries, and transactional feeds to generate real-time risk scores and alerts. Regulatory reporting engines pull data from multiple internal systems, reconcile discrepancies, and produce submissions tailored to the requirements of supervisors in different jurisdictions. For firms operating across Europe, Asia, Africa, and the Americas, these tools are essential to maintaining compliance without overwhelming human teams.

The convergence of cybersecurity and RegTech is increasingly evident. Regulations focused on operational resilience, such as the EU's Digital Operational Resilience Act and related frameworks in the UK, US, and Asia, require institutions to demonstrate not only that they can prevent and detect cyber incidents, but that they can respond and recover within defined tolerances. This pushes organizations to integrate security telemetry, incident response data, and regulatory reporting into unified platforms that can provide both operational insight and supervisory transparency. For executives and risk leaders who rely on DailyBusinesss for news and analysis, the message is clear: investment in RegTech and cybersecurity is no longer discretionary; it is a prerequisite for market access and stakeholder confidence.

Strategic Outlook: Fintech's Next Phase in a Complex World

Standing in 2026, it is evident that fintech has moved from disruptive novelty to critical infrastructure. The convergence of digital banking, blockchain, AI, open finance, advanced analytics, payment innovation, and RegTech has created a financial ecosystem that is faster, more data-rich, and more globally interconnected than at any previous point in history. Yet this progress unfolds against a backdrop of macroeconomic uncertainty, geopolitical tensions, climate risk, and shifting regulatory philosophies across North America, Europe, Asia, Africa, and South America.

For founders, investors, and corporate leaders who look to DailyBusinesss for insight across business, finance, investment, and the future of work, the next phase of fintech will reward those who can combine innovation with discipline. The most resilient business models will be those that integrate multiple capabilities-AI, data analytics, embedded finance, and robust compliance-into coherent, scalable platforms that address real customer needs across borders and cycles. Regions that can align regulatory clarity, digital infrastructure, and talent development will attract capital and become hubs for the next generation of fintech champions.

At the same time, the social and ethical dimensions of fintech will become more prominent. Questions around algorithmic fairness, data sovereignty, digital identity, and access to essential financial services will shape regulatory agendas and public trust. Institutions that proactively address these issues-through transparent governance, inclusive product design, and meaningful stakeholder engagement-will be better positioned to build durable brands and long-term value.

As fintech continues to permeate everyday life, from invisible payment flows to AI-assisted financial planning and tokenized assets, its impact on global economics, employment, and trade will only deepen. For decision-makers navigating this landscape, staying informed through rigorous, independent analysis is essential. It is precisely this intersection of technology, markets, and policy that DailyBusinesss is committed to exploring, helping its audience make informed, forward-looking decisions in a financial world that is being rebuilt in real time.