Crowdfunding in 2026: A Strategic Growth Engine for Modern Businesses

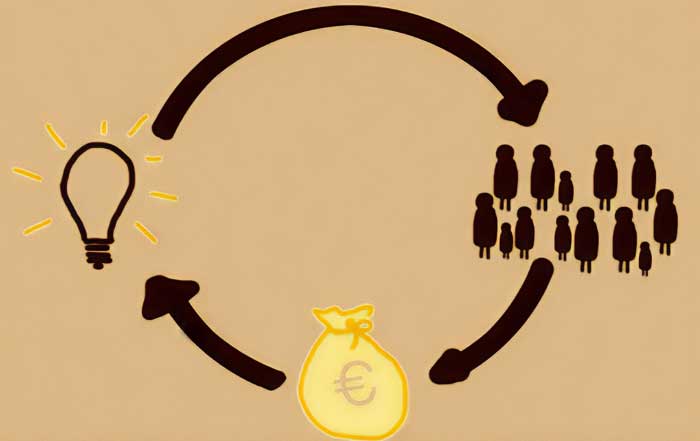

Crowdfunding has matured dramatically by 2026, evolving from a niche experiment into a core component of global business finance, and for the readership of DailyBusinesss.com, it now sits alongside venture capital, bank lending, and public markets as a serious, strategic option for growth-oriented companies. The convergence of digital platforms, regulatory innovation, and changing investor expectations has transformed crowdfunding from a simple online pledge mechanism into a sophisticated ecosystem that touches on AI, fintech, crypto, and cross-border trade, and it increasingly shapes how founders in the United States, Europe, Asia, and beyond think about capital, customers, and community.

For entrepreneurs and executives who follow business and markets coverage on DailyBusinesss.com, the central question is no longer whether crowdfunding is legitimate, but how to harness it as part of a broader financing and expansion strategy that supports sustainable, long-term value creation rather than one-off campaigns. In an environment defined by rapid technological change, heightened scrutiny of corporate governance, and shifting macroeconomic conditions, crowdfunding offers not only capital but also market validation, brand amplification, and direct access to engaged stakeholders, provided it is approached with the same rigor expected in institutional fundraising.

From Alternative to Mainstream: Crowdfunding's Strategic Role in 2026

The traditional hierarchy of capital-dominated by banks, private equity, and venture capital-has been reshaped by digital access, regulatory reforms, and global investor appetite for early-stage and growth opportunities. While bank loans and institutional equity remain vital, especially in markets such as the United States, the United Kingdom, Germany, and Singapore, they increasingly coexist with a spectrum of crowdfunding models that allow companies to diversify their capital stack and reduce dependence on single gatekeepers.

Reward-based platforms such as Kickstarter and Indiegogo have become well-established launchpads for consumer products, creative technologies, and design-led ventures, while equity crowdfunding portals regulated under frameworks such as the U.S. JOBS Act, the UK's Financial Conduct Authority rules, and the European Union's European Crowdfunding Service Providers Regulation have opened regulated access to both retail and sophisticated investors. Readers exploring investment insights on DailyBusinesss.com increasingly see crowdfunding rounds presented alongside seed, Series A, or growth equity transactions, as part of a multi-layered capital roadmap.

In parallel, debt-based crowdfunding and peer-to-peer lending, led by platforms such as Funding Circle, have offered small and medium-sized enterprises in markets like the UK, Germany, the Netherlands, and the United States a credible alternative to traditional bank credit, often with more flexible underwriting and faster decision cycles. Donation-based models, while more prominent in philanthropy and social causes, have also intersected with early-stage social enterprises and impact-driven ventures, especially those aligned with climate resilience, inclusive finance, and health innovation.

Core Models and Their Strategic Fit

At its essence, crowdfunding remains the practice of raising relatively small contributions from a large number of individuals, primarily via digital platforms, yet in 2026 the sophistication of those contributions and their legal form has expanded considerably. Reward-based crowdfunding continues to dominate consumer-facing innovation, where backers receive products, experiences, or recognition in exchange for their support. This model remains particularly attractive for hardware, design, and direct-to-consumer brands seeking to test demand, refine pricing, and validate product-market fit before committing to large-scale production.

Equity crowdfunding, by contrast, offers investors shares or other securities, and it has become central to growth strategies in technology, clean energy, and advanced manufacturing across North America, Europe, and parts of Asia-Pacific. Investors in these campaigns are not merely enthusiasts; they are, in many jurisdictions, regulated shareholders with rights, expectations of governance, and a long-term interest in value creation. Debt-based crowdfunding has found traction in markets where banks remain conservative, allowing companies with proven revenue but limited collateral to secure working capital or expansion loans from distributed lenders looking for yield diversification in a low or volatile interest-rate environment.

Donation-based models retain importance for mission-led organizations, social enterprises, and NGOs, particularly in emerging markets in Africa, South America, and Southeast Asia, where philanthropic capital, diaspora funding, and local community support intersect. For business leaders reading economics and global trends, the strategic decision is not whether one model is inherently superior, but which structure aligns with the company's growth stage, regulatory environment, sector, and appetite for shared ownership or leverage.

Platform Selection as a Strategic Market Choice

By 2026, choosing a crowdfunding platform is effectively a market-entry decision, not a mere administrative step. Each platform-whether global names like Kickstarter, Indiegogo, and Funding Circle, or regional equity portals in the US, UK, Germany, France, Singapore, or Australia-embodies a particular culture, investor base, sector focus, and expectation of professionalism. The decision signals to potential backers what type of company is being built, how it intends to communicate, and which governance standards it is prepared to uphold.

Some platforms have become synonymous with specific verticals: technology and design innovations, climate and sustainability projects, or real estate and infrastructure. Others specialize in regulated equity offerings, operating under the oversight of bodies such as the U.S. Securities and Exchange Commission or the European Securities and Markets Authority, and they often require robust disclosure, audited financials above certain thresholds, and clear risk statements. Entrepreneurs who follow AI and technology coverage on DailyBusinesss.com increasingly gravitate toward platforms that understand deep tech, SaaS, or frontier technologies, where investor education and due diligence expectations are higher.

Platform economics also matter: fee structures, payment processing, all-or-nothing versus flexible funding, and the availability of secondary markets or follow-on investment mechanisms all influence campaign design. A growth-stage company planning a multi-country rollout across Europe and Asia might select a platform with strong cross-border investor tools and multilingual support, while a US-based consumer brand targeting North America may prioritize a platform with a large, engaged domestic audience and proven logistics integration for reward fulfillment.

Narrative, Positioning, and the Professionalization of Storytelling

Despite the rise of data-driven targeting and algorithmic recommendations, the heart of a successful crowdfunding campaign in 2026 remains a compelling, credible story. However, the expectations of investors and backers are now closer to those of professional capital markets: they look for coherent strategy, clear unit economics, and a credible path to execution, not just a charismatic founder video. For the DailyBusinesss.com audience, used to reading in-depth business analysis, the narrative must integrate vision with operational reality.

The most effective campaigns articulate not only what the product or service is, but why the timing is right, how the team is uniquely equipped to execute, what competitive dynamics look like in target markets such as the United States, the United Kingdom, Germany, Japan, or Singapore, and how the capital raised will specifically accelerate growth milestones. Founders increasingly frame crowdfunding as a chapter within a longer strategic arc: early validation through reward-based campaigns, followed by equity rounds to scale production, and eventually institutional funding or strategic partnerships to support international expansion.

Visual communication has also become more sophisticated. High-quality video walkthroughs, factory or lab tours, data visualizations of market opportunity, and transparent breakdowns of capital allocation have become baseline expectations rather than differentiators. In sectors such as climate tech, health, and AI, founders often complement storytelling with references to independent research from organizations such as the International Monetary Fund, the World Bank, or the OECD, helping investors understand macroeconomic context and sector tailwinds without relying solely on internal projections.

Financial Discipline, Target Setting, and Credibility

As crowdfunding has professionalized, investors have become more discerning about financial realism. Campaigns that once relied on aspirational figures now face scrutiny from a global audience accustomed to reading financial news from sources such as the Financial Times, The Wall Street Journal, and Bloomberg, and to tracking macro indicators on platforms like the World Bank or OECD. Setting funding targets has therefore become an exercise in disciplined planning, not marketing bravado.

Companies now typically anchor their targets in detailed expansion plans: capital expenditures for new manufacturing capacity, regulatory approvals for entry into markets such as the EU or Japan, customer acquisition budgets calibrated to digital advertising benchmarks, and working capital buffers to manage supply-chain volatility. Increasingly, founders share scenario-based planning, explaining how they will deploy capital under base, upside, and downside cases, and how they intend to preserve runway if macroeconomic conditions tighten. Readers who follow finance and markets on DailyBusinesss.com will recognize this as an extension of traditional capital budgeting and risk analysis into a public, digitally mediated arena.

All-or-nothing funding structures still play a psychological role, signaling that a minimum viable budget is required to execute credibly, while stretch goals are framed as accelerants rather than necessities. Flexible funding, by contrast, is often paired with modular expansion plans, in which incremental capital unlocks discrete milestones such as additional territories, new product variants, or enhanced R&D.

Trust, Transparency, and Ongoing Communication

In a global crowdfunding environment that now spans North America, Europe, Asia, Africa, and South America, trust is the ultimate currency. Backers frequently operate at a distance, across borders and time zones, without the benefit of face-to-face meetings or traditional due diligence. Consequently, transparency and consistent communication have emerged as non-negotiable pillars of credible campaigns.

Professional teams now treat campaign communication as an extension of investor relations. They provide clear founder and leadership biographies, articulate prior track records, and disclose both strengths and limitations in a manner that sophisticated investors in New York, London, Frankfurt, Singapore, or Sydney can assess. Regular updates throughout the campaign, and especially post-funding, are expected: manufacturing progress, regulatory milestones, early customer feedback, and any changes to timelines or scope must be communicated clearly and promptly. Investors who are used to monitoring global business news expect the same level of candor and timeliness from crowdfunded ventures.

For equity campaigns, this ethos extends into formal governance: shareholder updates, annual or semi-annual reporting, and adherence to local securities regulations are increasingly standard. For reward-based campaigns, trust is reinforced through transparent fulfillment tracking, honest discussion of delays, and clear policies around refunds or substitutions in the event of unforeseen challenges.

Regulatory Maturity and Cross-Border Complexity

By 2026, the regulatory environment for crowdfunding has matured significantly, though it remains complex and jurisdiction-dependent. The United States continues to refine its Regulation Crowdfunding and related exemptions under the JOBS Act, while the United Kingdom, the European Union, Singapore, and Australia have developed increasingly harmonized yet locally nuanced frameworks. For founders and executives planning cross-border campaigns, regulatory compliance is now a strategic capability, not an afterthought.

Equity crowdfunding in particular demands adherence to securities laws, investor caps, disclosure requirements, and platform-level due diligence. Companies must understand how investor eligibility, marketing rules, and reporting obligations differ between, for example, the US, Germany, France, and Japan. Many now engage specialized legal counsel or compliance advisors early in the planning process, recognizing that missteps can jeopardize not only a single campaign but also future institutional funding rounds or potential exits.

Even in reward-based campaigns, regulatory considerations extend to consumer protection, product safety, export controls, and tax treatment across multiple territories. Businesses planning to ship products internationally must navigate customs regulations, standards compliance, and data protection laws such as the EU's GDPR, especially when handling customer and investor information. For readers interested in global trade dynamics, crowdfunding represents a microcosm of the broader regulatory and logistical challenges of cross-border commerce.

Operational Execution, Data, and Post-Campaign Discipline

The transition from successful campaign to successful business execution is where many ventures are now judged most harshly. In 2026, backers are acutely aware of past high-profile failures and delays, and they expect companies to demonstrate operational readiness before launching campaigns. Detailed production plans, validated supplier relationships, realistic logistics timelines, and contingency arrangements for key components have become hallmarks of credible projects.

At the same time, campaigns generate a wealth of data-demographic profiles of backers, geographical distribution of demand, conversion rates across channels, and qualitative feedback-that can inform strategic decisions far beyond the initial funding event. Companies with strong analytics capabilities, often leveraging AI-driven tools, use this information to refine pricing, prioritize markets, tailor marketing messages, and optimize product features. This analytical approach aligns with the data-centric mindset of investors and executives who follow technology and innovation coverage and expect decisions to be evidence-based rather than purely intuitive.

Execution discipline also extends to financial reporting against the original use-of-funds plan. Many teams now share post-campaign breakdowns of how capital was actually deployed, highlighting efficiencies gained, adjustments made, and lessons learned. This level of transparency reinforces trust and lays the groundwork for future rounds, whether through additional crowdfunding, venture capital, or strategic partnerships.

The Intersection of Crowdfunding, Crypto, and DeFi

One of the most significant developments since 2020 has been the gradual convergence of crowdfunding with digital assets and decentralized finance. While regulatory uncertainty remains in several jurisdictions, tokenization and blockchain-based fundraising have begun to influence how equity and revenue-sharing arrangements are structured, particularly in technology-forward markets such as the United States, Singapore, South Korea, and parts of Europe.

Tokenized equity and revenue-sharing tokens, when compliant with local securities laws, can offer enhanced liquidity through secondary trading on regulated exchanges, giving investors a path to earlier partial exits compared with traditional private equity. Smart contracts can automate aspects of revenue distribution, governance voting, and compliance, reducing administrative overhead and increasing transparency. Readers who follow crypto and digital asset developments recognize that these innovations remain in flux, but they increasingly shape investor expectations around access, liquidity, and programmability of capital.

At the same time, responsible issuers are cautious to distinguish between speculative token offerings and regulated, asset-backed digital securities. Reputable platforms now emphasize compliance, investor education, and robust custody solutions, often partnering with established financial institutions and regulated exchanges to bridge the gap between traditional finance and decentralized infrastructure.

Community, Brand Equity, and Long-Term Relationships

For all its financial and technological sophistication, crowdfunding retains a fundamentally human dimension: it enables companies to transform early customers and believers into active stakeholders and advocates. In an era where consumers in the United States, Europe, and Asia are increasingly values-driven and skeptical of impersonal corporate narratives, the ability to build authentic, participatory communities around a brand is a strategic asset.

Companies that treat backers as long-term partners rather than one-off financiers often benefit from repeat purchases, word-of-mouth referrals, and a steady stream of product feedback. They may invite early investors into beta testing programs, advisory communities, or exclusive events, creating a sense of shared ownership that goes beyond financial returns. This approach aligns closely with broader trends in stakeholder capitalism and sustainable business, where companies are judged not only on profitability but also on their relationships with customers, employees, suppliers, and local communities. Entrepreneurs interested in sustainable business practices increasingly see crowdfunding communities as a living embodiment of stakeholder engagement.

The brand equity generated by a well-run crowdfunding campaign can also support entry into new markets. Retailers, distributors, and corporate partners in markets such as Canada, Australia, Japan, or Brazil may be more willing to collaborate with a company that can demonstrate a loyal, engaged base of early adopters and a proven track record of delivering on its promises to a global audience.

Integrating Crowdfunding into a Holistic Capital Strategy

For experienced founders and executives, crowdfunding in 2026 is rarely a standalone tactic; it is one component of a multi-channel capital strategy that might include bootstrapping, angel investment, venture capital, bank credit, export finance, or even public listings in the longer term. Many companies now use crowdfunding as a way to de-risk subsequent institutional rounds, demonstrating traction, validating demand, and building a data-rich track record that can support higher valuations and more favorable terms.

In some cases, crowdfunding precedes or runs in parallel with traditional fundraising, allowing companies to negotiate from a position of strength. In others, it follows institutional investment, with venture capital firms or strategic investors viewing community ownership as a brand asset rather than dilution. For readers who follow founder journeys and entrepreneurial stories, this blended approach reflects a more nuanced understanding of capital as a portfolio of options rather than a single binary choice between debt and equity.

Critically, integrating crowdfunding into a broader financing roadmap requires careful attention to cap table management, investor rights, ongoing reporting obligations, and alignment between the expectations of retail backers and institutional partners. Companies that manage this alignment well often find that their crowdfunding community enhances rather than complicates future growth.

Crowdfunding as a Marker of Modern Corporate Competence

By 2026, successful use of crowdfunding is increasingly seen as a signal of managerial competence and strategic agility. It demonstrates that a team can communicate clearly to a broad audience, comply with evolving regulations, manage complex logistics, analyze data, and build trust at scale. For readers of DailyBusinesss.com across North America, Europe, Asia, and beyond, crowdfunding campaigns have become windows into how a company operates under public scrutiny, long before an IPO or major strategic transaction.

In an environment defined by rapid technological change, shifting consumer expectations, and heightened attention to sustainability and ethics, crowdfunding also offers a mechanism for companies to align capital raising with their broader values. It allows them to invite stakeholders into the journey from an earlier stage, to test and refine products collaboratively, and to demonstrate, in real time, the integrity and resilience of their operations.

As global markets continue to evolve, and as digital platforms further integrate AI, blockchain, and advanced analytics into their infrastructure, crowdfunding is likely to become even more embedded in the financial architecture of entrepreneurship. For founders, executives, and investors who follow the evolving landscape through DailyBusinesss.com, mastering the strategic, operational, and ethical dimensions of crowdfunding is no longer optional; it is a core competency for building resilient, future-ready businesses in a connected, demanding, and opportunity-rich global economy.